TeraCash 2013

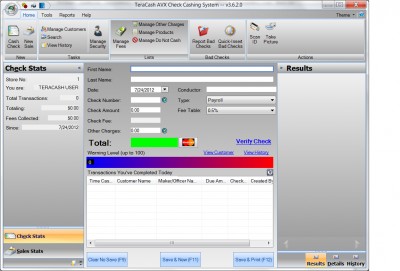

TeraCash is a unique and affordable check cashing application designed to assist you in keeping up with all aspects of your check cashing business.

TeraCash is a unique and affordable check cashing application designed to assist you in keeping up with all aspects of your check cashing business.

|

TeraCash is a unique and affordable check cashing application designed to assist you in keeping up with all aspects of your check cashing business. Utilizing state-of-the-art technologies, TeraCash delivers the quality and performance you should expect in world-class business software.

With features such as Biometric fingerprint Identification, picture identification and a highly sophisticated method of verifying check integrity, you'll find that our check cashing solutions is the one-stop solution you'll need to help you run a profitable business!

With TeraCash, you'll have all the tools you need to help your company run a successful and profitable check cashing business! With quick, easy to use screens, multi-lingual text, (English and Spanish) and an array of administration tools backed by a highly scalable database engine, you can rest assured that you will be using these tools for years to come!TeraCash is a check cashing software.

Included check fraud protections helps you keep track of bad check writers by using a highly sophisticated mathematical algorithm which determines the risk - out of a possible 100 - as to whether or not the check you are receiving will be valid. For an added level of protection, ask us about our CheckProtect Service!

By subscribing to our network of known check cashers, you will be able to determine with an even greater level of accuracy the validity of each check. CheckProtect provides a full range of security measures including fraudulent check cashers and known phony check writers! Try a fully functional evaluation of TeraCash with one free month of CheckProtect now!

TeraCash features

Once a customer has been entered into your system, subsequent transactions can take as little as 5 seconds to process! Using our MagTek check reader or scanner, all you have to enter is the check amount and the check number! You can optionally choose to print a receipt or just begin the next transaction! It's that quick!

Currently, there are two languages supported. The English (US) version and the Spanish (Mexico) version. This allows you to operate the TeraCash⢠Check Cashing System in the language you feel most comfortable in!

Customer information entered into the system, stays in the system. This allows for faster transactions for returning customers as well as the ability to build custom reports to track such things as customer details and frequency of visits, monthly transactions, total transaction amounts, etc.

Each transaction created is automatically stored into history for future investigation. This eliminates the need to keep all transaction records stored away in file cabinets or boxes. All data is stored digitally and can be easily reprinted or manipulated whenever you need to! Want to scan and keep ALL of your documents into digital formats for easier retrieval and to uncluttered your office by eliminating paper tracking nightmares? Ask us about TeraDOXâ¢! Digitize important documents, receipts, bills, reports, IRS forms, loan application, pictures, and much much more!

Our exhaustive searching capabilities allows you to search for any information you enter into the system. Customer information, bank information, company information or transaction information all on one simple-to-use search screen!

TeraCash⢠automatically backs up your data every time you exit the system. This allows for an added layer of redundancy in the event that something happens to your database due to circumstances beyond your control! Once the backup completes, simply use your favorite off-site backup solution to move the data to a safe location such as a fire-proof safe or safety deposit box!

With an optional check reader or scanner, TeraCash⢠provides the ability to automatically read the magnetic stripe on the bottom of the check and populate the transaction screen with all the customer information. Not only does this make transaction time faster, but it also ensures that the check is not a photocopy of the original. If the check cannot be read with the MICR reader, then it likely does not contain magnetic ink and should be carefully inspected prior to acceptance. Additionally, you can use a MICR check scanner to both verify the magnetic ink of the check as well as scan the front and/or back of a check to keep a copy on file for your records*.

TeraCash⢠supports multiple users - each with individual rights. Rather than supporting only two broad categories of users (usually general users or administrators), TeraCash⢠utilizes task-specific rights and privileges assignable to each individual user. For example, a general user may be allowed to create transaction, but not view client history, override pre-defined fees or print accounting reports. On the other hand, your accountant may be able to print reports but not create transactions. This level of security is available for virtually all tasks within the TeraCash⢠Check Cashing System. Additionally, each user can be assigned his or her own virtual drawer to keep track of start and finish amounts. If user-security allows, at the end of a user's shift, they can print their drawer receipt to balance all of their transactions. Otherwise, you can print a drawer report for all users at the end of the day.

For those who accept multiple type of checks, TeraCash⢠offers the flexibility to assign different fee structures for the various types. For example, you may wish to assign regular payroll checks one set of fees because their higher risk, but assign a lower fee structure for tax refund checks since those checks are backed by the US government. This feature also allows you to offer certain customers (such as recurring customers or a membership incentive) discounted fee rates using the same principal. For example, if you want to offer all customers a yearly membership, you could create a new fee type called "Members" and set up a discounted fee schedule for them and still maintain the regular fee schedule for all members who choose not to enroll.

TeraCash⢠employs a highly sophisticated mathematical algorithm for determining the validity of each check processed. Using an algorithm which takes into account good and bad checks, number of checks accepted, length of time of each check and a number of other variables, a probability number is generated (between 0 and 100) as to whether or not this check should be accepted. This number serves as a reference to help you better determine what risks you would like to take when accepting checks.

TeraCash⢠offers you the ability to scan an external document to aid you with the verification process. Some examples of a document you may wish to scan are identification card, drivers license, alien registration card, social security card, or any other document that may help you or your employees verify the identity of your customer. If an external document has been scanned for a particular customer, when that customer record is pulled up in the transaction screen, the scanned image will automatically appear at the top right of the screen for quick and easy viewing.

For check cashers who cash check on a companies behalf. For example, if an officer of ABC Corporation wants to cash a check which has been made out to ABC Corporation, TeraCash⢠supports switching the customer mode from Individual to Corporate. Therefore, your customer will be ABC Corporation and the "Company" will change to the officer of ABC Corporation who is cashing the check on behalf of ABC Corporation.

Checks that are returned for any number of reasons (such as NSF, closed account) can be automatically entered into the TeraCash⢠system by either entering the check information into the bad check screen or scanning the check while in the bad check screen** Once entered into the system, it will be assed and appended to the calculation formula used to determine the risk-based calculated number as described in the fraudulent check probability section of this site. Additionally, TeraCash⢠provides a way to manually enter in all of your existing bad checks to also be calculated into the system. This includes any checks past or present that you have prior to implementing the TeraCash⢠Check Cashing System.

With an optional receipt printer, TeraCash⢠supports the ability to print transaction receipts for your customers. These receipts can be printed on 8.5"x11" paper, but will only print to the width of 3 inches. All other reports included are designed to be printed on 8.5"x11" paper natively. Custom reports are available upon request and can be fitted to match any reasonable size your printer will support.

For added protection against accepting bad checks, read about our CheckGuard service. For more information check out our CheckGuard service page.

Because TeraCash⢠is built using state-of-the-art technologies and world-class data engines, we can offer a highly scalable network solution for even the largest clients. TeraCash⢠supports any type of network configuration; peer-to-peer, local area (LAN) or even wide area (WAN) networks can be easily configured and utilized with minimal setup or knowledge of databases. If you are looking for an advanced network solution for your check cashing business, contact us directly for more information and to determine which method will work best for you!

To assist you in validating that clients presenting checks are really who they say they are, TeraCash⢠offers picture recognition. Using your USB or digital camera, you can take a snapshot of each new customer during the registration period and store that in their permanent file. Each time that customer presents a check to you, their picture will pop up on your screen for face recognition. For an added layer of recognition, read about our newly added Biometric Fingerprint Recognition!

TeraCash⢠now supports the BioCert Hamster III. A biometric fingerprint reader used for verifying the identity of your clients. This eliminates the possibility of individuals cashing checks which do not belong to them by associating a fingerprint signature with each account. TeraCash⢠does NOT store fingerprint images. All actual fingerprint images are discarded as to preserve your client's privacy! TeraCash⢠stores a fingerprint signature which aids in identifying an individual who wishes to cash a check at your establishment.

The data stored in the fingerprint record is completely worthless to anyone except the person with whom the finger belongs. Even then, the fingerprint data is of no use until that individual places his or her finger onto the fingerprint reader. This level of security ensures that you gain all of the added benefits of matching your customers to their checks and none of the pitfalls of scaring away customers by infringing upon their privacy. For more information about Biometrics, or our partner, Biometrics Direct, as well as learning about other software available using Biometric technology, visit http://www.BioCert.us.

Check 21 allows businesses or institutions receiving a significant number of checks to instantly convert those checks to Check 21 compliant bank exchangeable images. This process reduces banking costs, eliminates the need for lock box programs, accelerates cash flow and provides an online archive of all images.

Prior to Check 21, only consumer to business checks could be remotely scanned and settled electronically.

Federal Check 21 legislation enabled the deposit and clearing of all types of paper checks -- including business to business checks -- through electronic image transfer. Payroll, corporate, commercial, treasury, travelers and consumer checks can now be digitally imaged, deposited and settled electronically without making any trips to the bank.

The CTR (Currency Transaction) report is designed to be printed and mailed to the US Treasury for any customer who meets or exceeds a total transaction amount of $10, within 24 hours time. This report is required whether they cashed one check meeting that criteria, or multiple checks. You do not have to keep track of this using the TeraCash system. At the end of your day, simply run this report, select the date you wish to run it for and if any customers on that day match that criteria, TeraCash will automatically print the report(s) for those customers. If no customer meet that criteria, a message will be displayed alerting you and no report(s) will be printed.

The SAR (Suspicious Activity) report is designed to be printed for any customer who you reasonably suspect may be involved in illegal activity. This may include the following: (as stated on the form itself)

This report is usually specific to wire transfer and money order companies but can also be applied to check cashing companies as well.

In some cases, the IRS may request a listing of all customers who have cashed over $10, worth of checks in a given year. This is generally done by request, but may differ in other states. Check with your local IRS agent to see if and/or when this report may be necessary.

TeraCash⢠now offers a fully integrated help file. From any screen you want help from, you can press the F1 key on your keyboard and the associated help file will appear giving you further instructions about that screen.

TeraCash⢠now includes bank data from the American Banking Association. This includes available names, address and phone numbers. This data is separate from TeraCash⢠but includes an Import feature to add all of the banks into your database. This data is updated annually.

Requirements

tags![]() check cashing the check the system into the you can abc corporation bad check and the entered into the ability for example teracashv¢ supports for any

check cashing the check the system into the you can abc corporation bad check and the entered into the ability for example teracashv¢ supports for any

Download TeraCash 2013

Purchase: ![]() Buy TeraCash 2013

Buy TeraCash 2013

Authors software

TeraCash 2013

TeraCash 2013

TeraCorp Enterprises Inc

TeraCash is a unique and affordable check cashing application designed to assist you in keeping up with all aspects of your check cashing business.

Similar software

TeraCash 2013

TeraCash 2013

TeraCorp Enterprises Inc

TeraCash is a unique and affordable check cashing application designed to assist you in keeping up with all aspects of your check cashing business.

Check Designer Home & Business 7.0.0.0

Check Designer Home & Business 7.0.0.0

Avanquest Software

Balance your checkbook, organize your finances and print custom checks.

MemDB Check Printing System 1.0

MemDB Check Printing System 1.0

MemDB Technology Company

This program helps you to manage your customer information and prints check to your customers.

![]() Bad Check Tracker 2.0.3

Bad Check Tracker 2.0.3

Corporate Consultants

Bad Check Tracker is a useful finance tool that provides an fast and easy method for retailers to keep on top of NSF checks and overdue accounts.

Instant Check 4.2.02

Instant Check 4.2.02

Easy Desk Software

Instant Check create a check and deposit it without waiting for the mail to arrive or hoping that your client will remember to send you one.

Check In/Out Organizer Pro 1.6

Check In/Out Organizer Pro 1.6

PrimaSoft PC, Inc.

Check In/Out Organizer Pro is a flexible check-in and check-out transaction tool that you can easily customize to your specifications.

ezPayCheck 2.0.5

ezPayCheck 2.0.5

HalfPriceSoft

ezPayCheck is a comprehensive and affordable full-featured small business payroll preparation and check printing software.

Check Studio Personal Edition 1.0

Check Studio Personal Edition 1.0

Cox, Smith & Associates

Check Studio is a complete check printing application created to completely replace one or all of your check books.

Medlin MICR Check Printing 2012

Medlin MICR Check Printing 2012

Medlin Accounting Shareware

Medlin MICR Check Printing is an add on module for Medlin's Payroll Software and Medlin's Accounts Payable Software.

MICR Font Set 7.8

MICR Font Set 7.8

Elfring Fonts, Inc

Want to print your own checks on your laser printer from Windows? The bottom sequence of numbers on a check must be printed in a special font called MICR or E-13B.

Other software in this category

JobCost Controller for Excel 11.1

JobCost Controller for Excel 11.1

CPR International, Inc.

Construction Jobcost Tracking System for Excel.

7OfficeDemoWin 3.0.3

7OfficeDemoWin 3.0.3

7Office Inc.

7Office is an enterprise solution for small business.

7ContactWin 3.0.3

7ContactWin 3.0.3

7Office Inc.

7Office is an enterprise solution for small business.

II_WorkSchedule 6.61

II_WorkSchedule 6.61

Image Integration

II_WorkSchedule is a useful electronic personal-management software for Companies.

Real-time Foreign Exchanger 2.11

Real-time Foreign Exchanger 2.11

Hunter Soft

The software is a break-through in the field of Foreign Exchange Rate software.